We’re fixing orderflow execution!

(for around the hundredth time)

Liquidity and product fragmentation is awful in crypto. Not only do you have a million exchanges -the exchanges all have

different properties and settlement times, some continuous, some discrete.

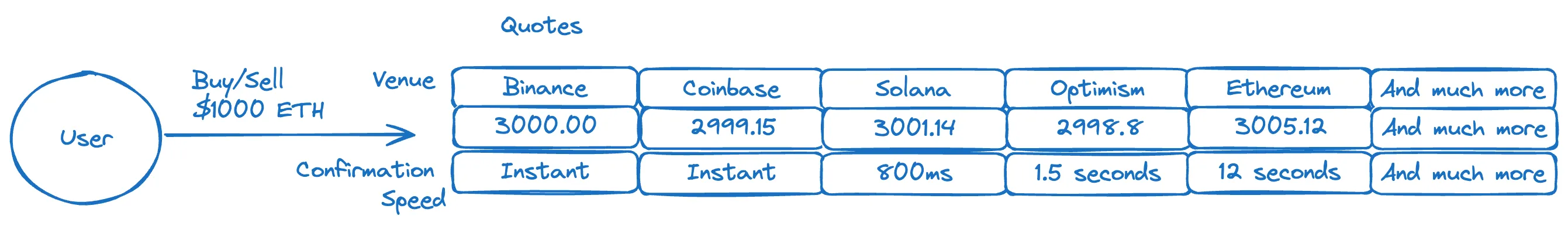

A user that wants to trade their ETH has a liquidity space that looks something like this:

The user should execute against a set of these exchanges to get the best price, but they’re not sophisticated enough to

do so, so they trade on Ethereum with a market maker and the market maker hedges on all the other domains.

This solves the problem, but now you’re limited by where the market maker will hold inventory and what assets they’ll

hold inventory of. AND you need to compensate the market maker for warehousing inventory and risk.

On top of that we now run into a harder problem.

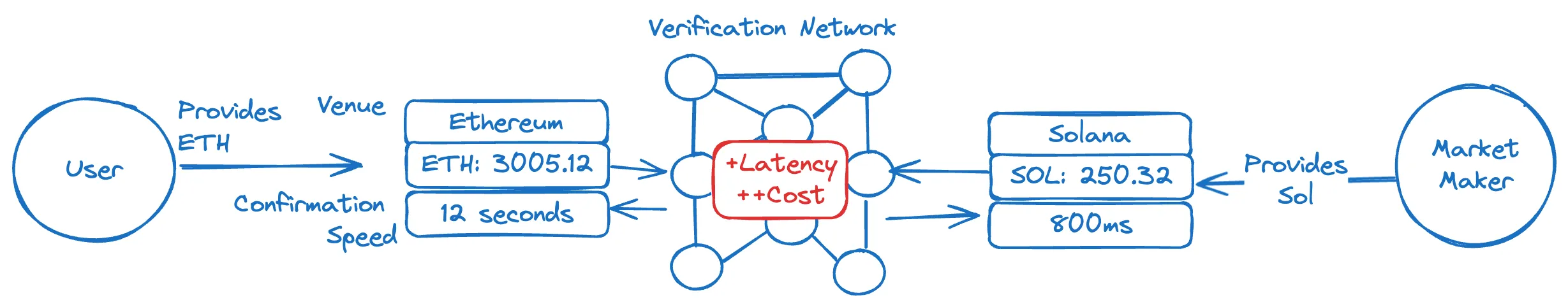

Imagine a user has ETH on Ethereum and wants to trade it for SOL - which is only available on Solana. Well now you need to send your ETH to the market maker on Ethereum, at which point they’ll use their inventory on Solana to purchase you the expected amount of SOL and send it to you on Solana.

The problem is we’re in a permissionless, decentralized setting where you don’t know or trust the market maker so the assets needs to remain escrowed until it can be proved the transfers were made. Now your execution looks like this:

So now you’re paying verification costs, have latency overhead, and you’re paying market makers to warehouse inventory and risk. Your execution sucks!

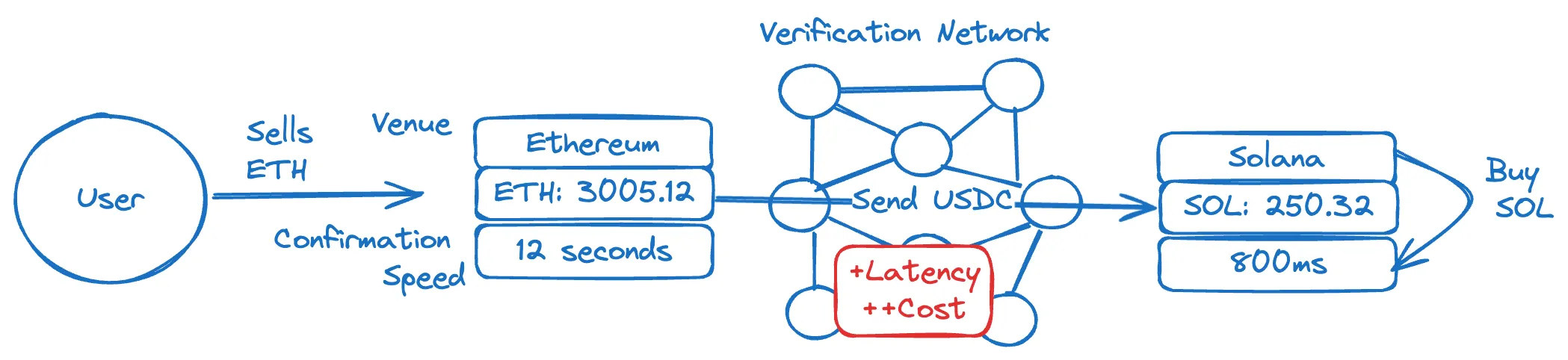

You could try cutting out the market maker by moving user funds between domains

but now your latency overhead is crazy so you don’t get good fills and you still need to pay verification costs to transfer funds. Your execution still sucks!

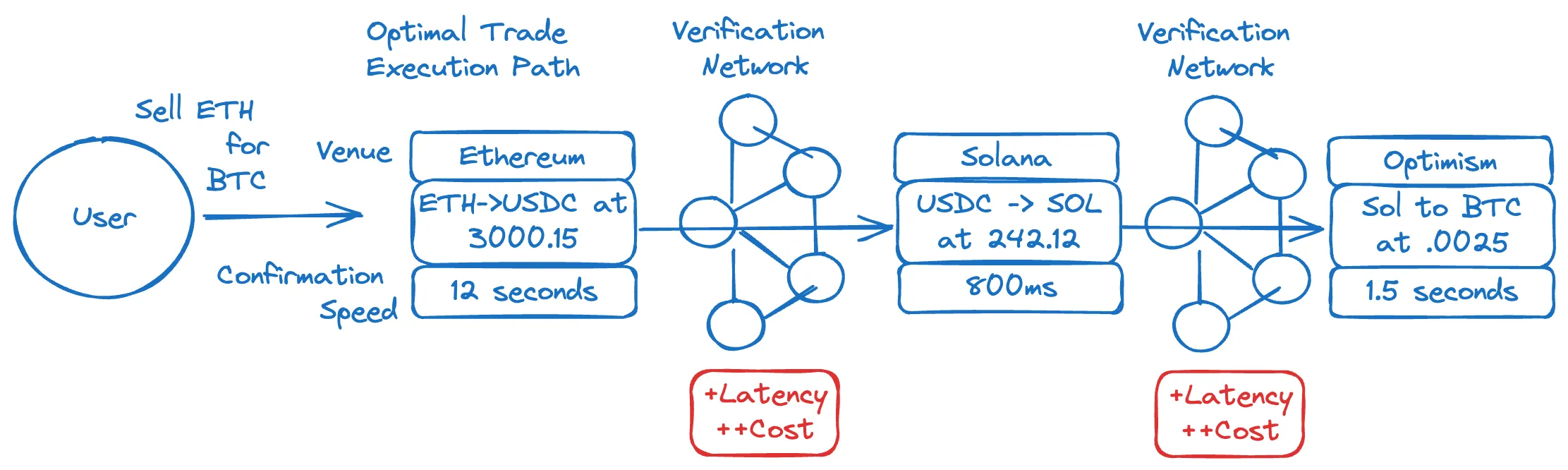

And imagine how complicated this gets when the optimal trade route is more than 2 hops - ie:

The core problem here is that in a trustless, decentralized setting it’s really difficult to asynchronously execute over multiple liquidity venues. So execution and asset availability suck. t+ solves this.